Turn Every Mile Into Tax Savings

Effortlessly track your business miles and maximize your tax deductions. Built for self-employed workers and 1099 contractors who value simplicity and accuracy.

Everything You Need to Maximize Deductions

IDash combines powerful tracking with an intuitive interface, making mileage logging effortless for busy professionals.

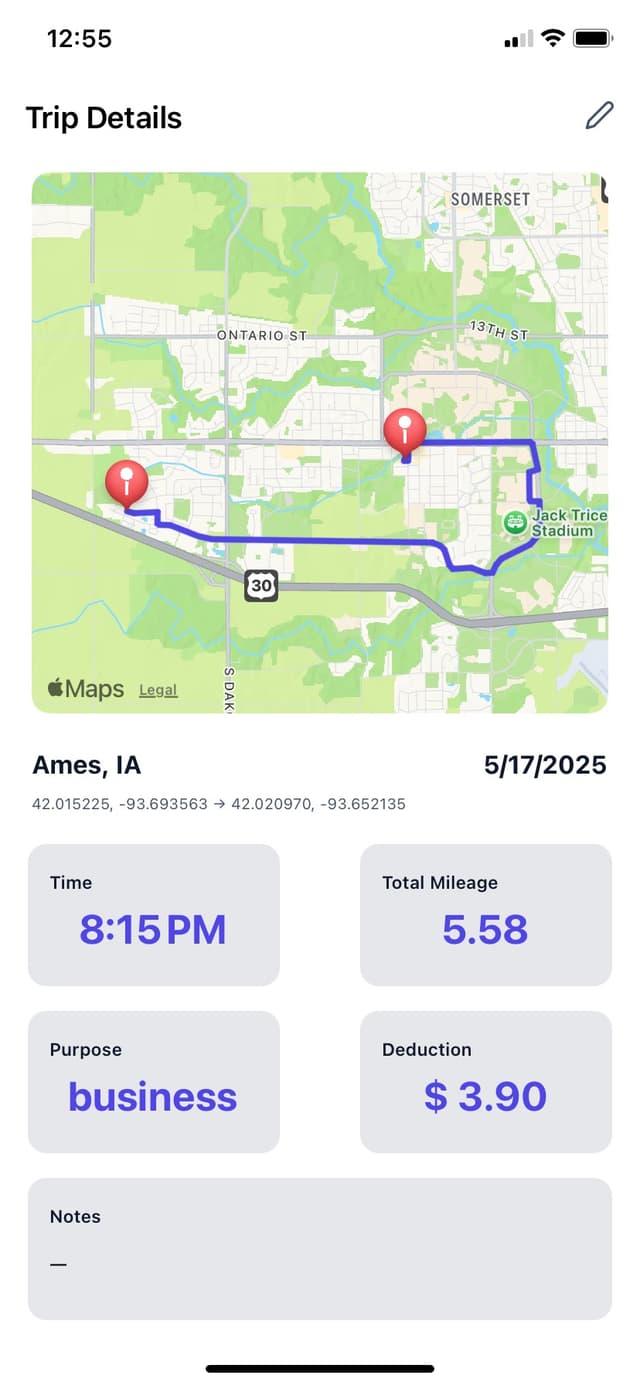

100% IRS Compliant

Built to meet all IRS requirements for mileage deductions. Automatic date, time, location, and purpose tracking ensures audit-ready documentation.

Real-Time Savings Calculator

See your potential tax savings instantly as you drive. Know exactly how much you're earning back with every business trip you take.

Export Ready Reports

Generate detailed reports in multiple formats. Perfect for tax preparation, accountant sharing, or business expense tracking.

Simple as 1-2-3

Start tracking your mileage in seconds, not minutes

Tap to Start

One tap begins tracking your trip. IDash automatically captures location, distance, and time data in the background.

Drive Normally

Focus on your business while IDash works silently in the background. No need to worry about manual entries or forgotten trips.

Review & Export

Review your trips, see your savings, and export reports when needed. Everything is organized and ready for tax time.

Ready to Start Saving?

Join thousands of self-employed professionals who are maximizing their tax deductions with IDash.

Download IDash Now - It's Free